Corporate commitments to become net-zero by 2050 became so trendy this year, Canada’s big banks made them twice.

First came a string of promises one by one, starting with TD Bank late in 2020 followed by the other banks throughout 2021. In November, they all recommitted to the goal as they joined former Bank of Canada governor Mark Carney’s Glasgow Financial Alliance for Net Zero.

But while the round numbers seem like a neat solution, the U.N. and others have emphasized that much of the heavy lifting on emission reductions needs to happen this decade, and only through details to be released in the next year or so will it start to become clear how quickly Canada’s big banks are prepared to move.

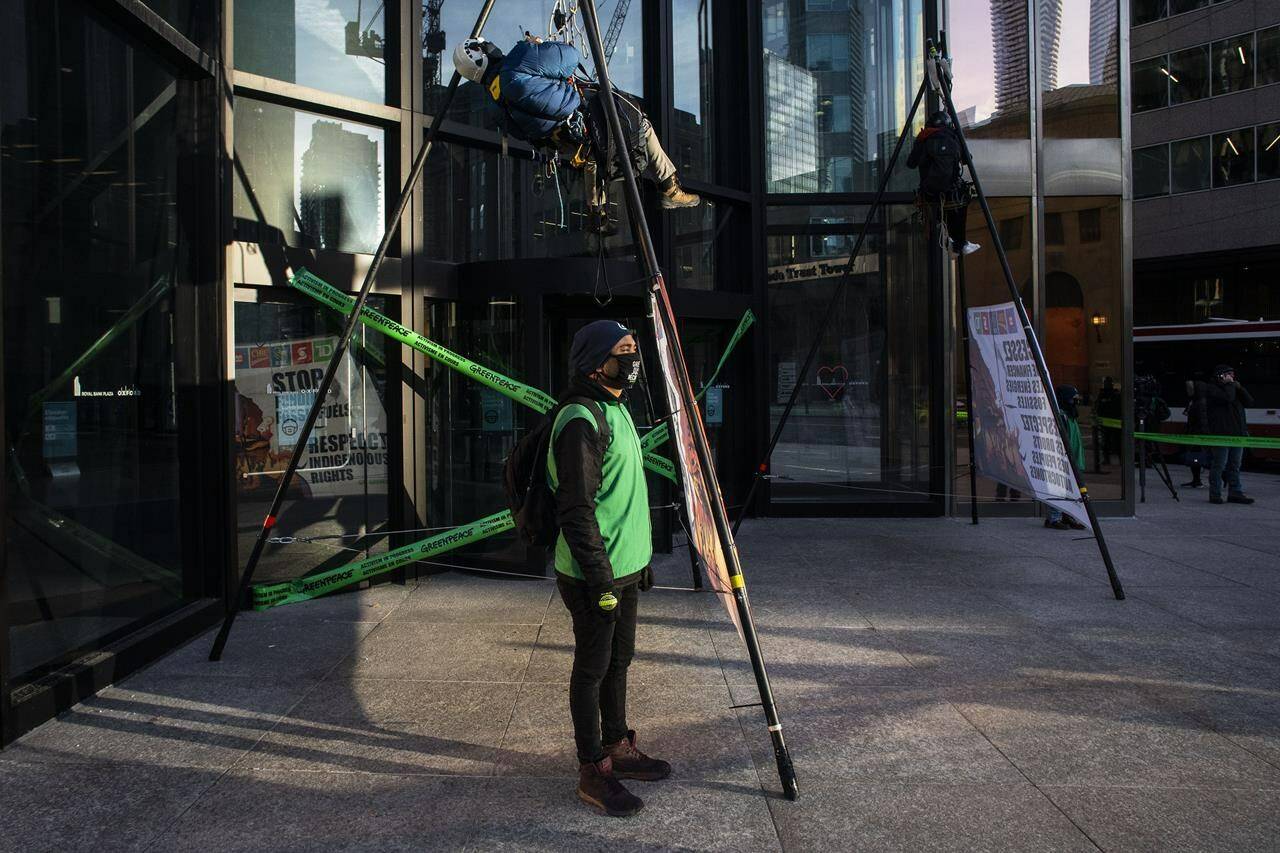

Pressure is certainly mounting as Canadians live through the very real effects of climate change, and activists increasingly focus their efforts on the financing behind fossil fuel production.

Governments are also increasingly moving toward climate action, including the huge shift in direction brought by U.S. President Joe Biden, raising the spectre of regulation if the industry doesn’t change fast enough.

And the finance industry is increasingly talking about the importance of action, and putting the standards and data together that will allow for potentially meaningful moves on climate change.

“There’s nobody who’s not aware of it, there’s not a single continent that isn’t deeply impacted,” said Margaret Franklin, chief executive of the CFA Institute, which put out sustainable investment disclosure guidelines in November.

“That urgency is starting to create co-operation. So where we would have seen a cluttered, disjointed, chaotic disposition, everybody coming out with everything, now you’re starting to see the centrifugal force of consolidation.”

But while there’s change underway, Canada’s big banks are still major funders of the fossil fuel industry, which produces relatively cheap energy at an environmental cost that’s becoming increasingly clear.

Two independent reports out this year by activist groups show that Canada’s Big Five banks—Royal Bank of Canada, TD Bank, Bank of Nova Scotia, Bank of Montreal and Canadian Imperial Bank of Commerce — supplied around $700 billion in funding and underwriting to fossil fuel companies since the world formally agreed to rein in greenhouse gases with the 2015 Paris Accords.

Reducing that access to capital is key because it can make fossil fuel projects more expensive, and potentially change the balance of whether it’s more worthwhile than the lower-carbon alternatives, said Keith Stewart, senior energy strategist with Greenpeace Canada.

“By choking off funding to fossil fuels, you’re creating greater urgency on the other side to find those projects and get them underway.”

Canada’s big banks have also committed to mobilizing hundreds of billions of dollars in sustainable finance to help emission reduction efforts this year, but Stewart and others have raised concerns about the stringency of standards around that lending, and how Canadian standards, currently being drafted, could fall short of what the European Union has already established.

Overall, Stewart said the banks have been relatively slow to respond to the climate issue, and that they now want to be able to “sell gasoline to the arsonists and water to the fire department.”

Canadian banks have framed it more around taking a cautious, balanced approach.

Lindsay Patrick, head of strategic initiatives and ESG at RBC Capital Markets, said the bank is trying to advance financial, social, and environmental outcomes together.

“The balance is how fast do you reduce emissions, and at what disruption to any economic and social consequences might there be.”

She said RBC, which has been particularly targeted by activists as the largest fossil fuel funder in Canada, had no plans to stop funding new projects.

“We continue to think there is a role for that sector to play, particularly as their end product continues to be consumed by the likes of all of us on a daily basis.”

Patrick said that future funding for fossil fuel projects could theoretically open new, lower-emission production that could displace higher-emitting projects, but made no assurances.

Banks have been thin on details about how they plan to achieve net-zero financed emissions, so activists are watching closely for interim emissions targets and any plans to achieve them.

In their own net-zero announcements, banks haven’t said exactly when they would set those targets, but some indications for key sectors should start to emerge next year.

Meanwhile Carney’s net-zero club gives members 18 months to come up with targets, with the direction that they should set 2030 goals that represent “a fair share” of the halving of emissions needed by then.

Investors should also soon get a better sense of just how banks are financing emissions, after Canada’s Big Six all joined the Partnership for Carbon Accounting Financials as part of their net-zero commitments. The partnership standardizes reporting around financed emissions, with banks expected to release baseline data next year.

Banks can also expect increased activism in the year ahead. The example of Exxon Mobile Corp., where a small hedge fund managed to gather enough support to install three climate-focused directors over the company’s objections earlier this year may have provided a wake-up call about how quickly things can turn.

The commitments made so far show the banks are already aware of the growing pressure, said Anthony Schein, director of shareholder advocacy at the Shareholder Association for Research & Education.

“I think they’ve been responsive to investors, to policy-makers, to the way the wind’s blowing. They’ve started to make some really positive commitments in the last 12 months. They’ve still a long way to go.”

He said shareholder resolutions could focus on the banks committing to stop funding new fossil fuel projects, as well as pushing them to be faster, more detailed, and ambitious on interim targets. These more near-term details are needed because 2030 is within the range of capital budgets and of what companies are planning for now.

“Yesterday is the timeline of when we need to see those plans.”

Ian Bickis, The Canadian Press