Plastic resins — tiny plastic pellets used to make everything from bread bags to milk containers — are undergoing a triple whammy of high demand, tight supply and soaring prices.

The raw ingredient that forms the base of all things plastic is emerging as the tiniest example of how COVID-19 is causing enduring supply chain turmoil.

Industry experts say the ongoing shortage of the ubiquitous material is unlikely to be resolved quickly, and that plastic resin price hikes are trickling down to consumer goods and adding to inflation.

“The conditions are very, very challenging,” said Bob Masterson, president and CEO of the Chemistry Industry Association of Canada, which represents the plastics industry. “These are prices the market has never seen.”

It started at the outset of the pandemic with a massive spike in demand for personal protective equipment like masks, face shields, gloves and gowns — much of which is made of single-use plastics.

The health crisis also shifted consumer buying habits. The stockpiling of groceries spurred demand for plastics — even toilet paper is wrapped in plastic — while grocers upped their plastic use to wrap or bag food for both in-store and online purchases.

Moreover, the shifting of food dollars away from restaurants — which buy food in larger bulk containers — to grocery stores also nudged up plastic packaging use more broadly.

At home improvement stores, as the price of lumber reached dizzying heights, some shoppers turned to materials made with plastics like composite decking or plastic sheds.

“COVID-19 led to a significant expansion in demand for plastic products across a range of market segments,” Masterson said, noting that by the end of 2020, plastic production and consumption hit record levels in North America.

Yet just as demand was peaking, supply took a dive.

Many plastic resin makers deferred maintenance on their facilities early in the pandemic, but Masterson said that activity cannot be delayed further. A number of facilities are currently off-line for maintenance, he said.

That comes after a year of severe weather events along the U.S. Gulf Coast that have idled numerous chemical plants for weeks. Hurricane Ida is the most recent storm to shake up the industry and create a more challenging situation in the short term, Masterson said.

At the same time, construction of new facilities slowed. For example, Inter Pipeline Ltd. said in May 2020 that the pandemic had affected near-term construction plans on its $4-billion Heartland Petrochemical Complex near Edmonton. The facility will turn propane into polypropylene, a material used in a range of products like medical supplies and lightweight automotive parts.

The tight supply along with the ongoing strong demand has sent plastic resin prices through the roof.

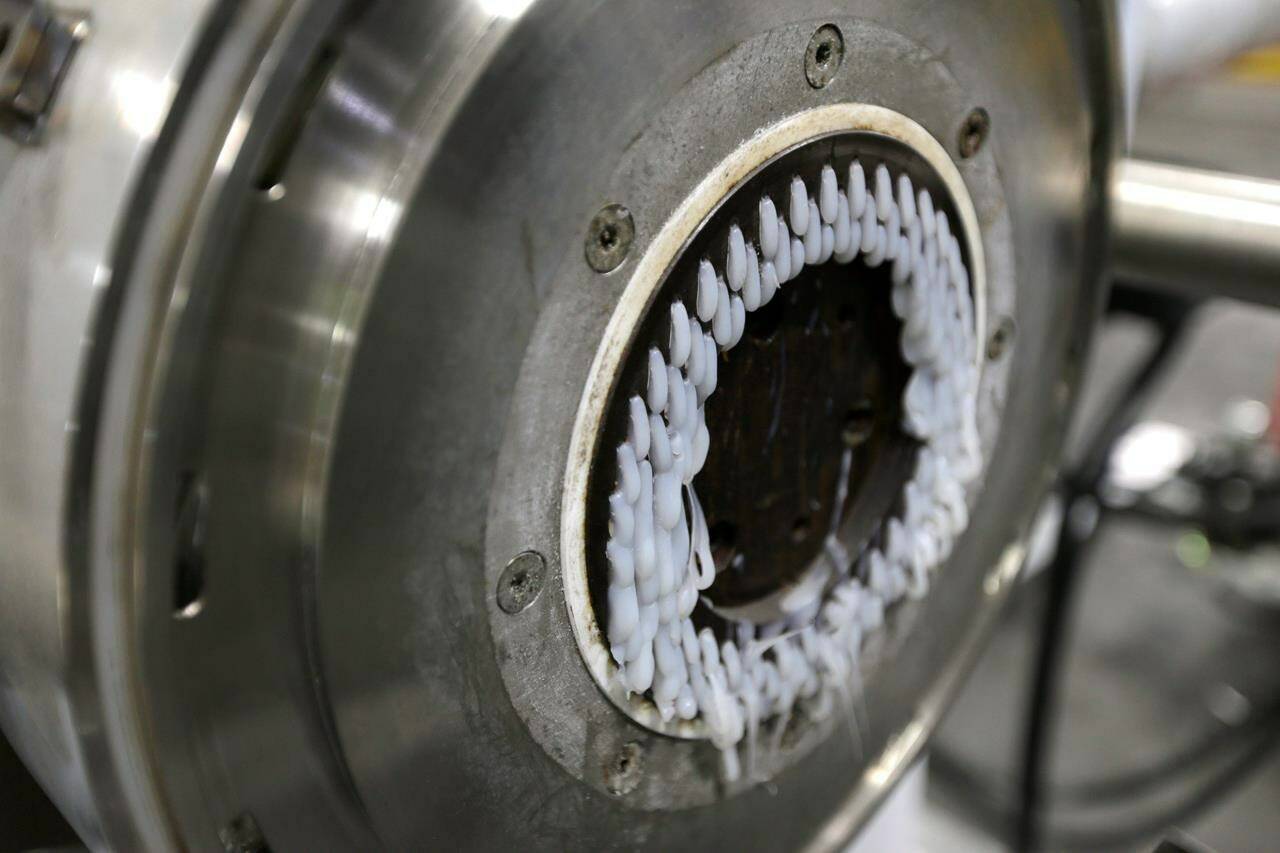

“Within the first year of the pandemic, the price of our raw material was up 107 per cent,” says Joel Rudolph, chief operating officer of Farnell Packaging Ltd. The company near Halifax uses plastic pellets to make flexible packaging primarily used in the food industry.

“We’ve now seen almost two years of unprecedented increases. We’ve had some really rough months.”

Still, the cost of the plastic packaging on food items is a small part of the overall cost consumers pay, which means higher plastic prices on their own shouldn’t cause sticker shock for shoppers, he said.

“On the price of bread, the cost of the plastic bag is a very low percentage of the overall cost,” Rudolph said.

Yet experts say plastic prices are one of several factors pushing up the cost of materials and contributing to rising inflation.

Statistics Canada said last month the annual pace of inflation rose to 3.7 per cent in July, the biggest increase since May 2011. The price of so-called durable goods, which includes many items made with plastic, increased at an even faster pace of five per cent.

Indeed, the rising cost of plastic resins was cited in Canadian Tire Corp.’s recent earnings call as one of the inputs causing “inflationary pressure” on the retailer.

“We would have seen commodity cost pressure in products made with plastic resin, like storage containers,” TJ Flood, president of the Canadian Tire retail chain, said during the company’s second quarter conference call with analysts last month.

Toymaker and children’s entertainment company Spin Master Corp. also discussed rising plastic resin prices during its latest earnings call.

“We continue to see increases in input costs, primarily from plastic resin, paper and cardboard packaging and more recently from electronic chips and particularly ocean freight,” Mark Segal, Spin Master’s executive vice-president chief financial office told analysts in August.

Both Canadian Tire and Spin Master declined to comment further on plastic resin prices.

While the situation is unlikely to be resolved soon, Masterson said it should begin to ease as the backlog of demand is filled and new facilities come online.

Inter Pipeline said its plastic facility is expected to begin making polypropylene in early 2022.

ALSO READ: Small businesses face threats, backlash as vaccine passports take effect

Brett Bundale, The Canadian Press