Money, Money, Money, must be funny in a rich man’s world.

For many of us, finances, tax season and budgeting are less “funny” and more stressful. As with most stressful topics, many people shy away from discussing, learning about or changing their habits around finances. To make this particular money chat more fun we’ve opted to take a more unconventional approach.

We’ve employed the lyrical genius of 1970s Swedish pop sensations ABBA to make this money talk a little less serious and a lot more fun. Try to figure out how many ABBA lyrics we’ve managed to work in and by the end you’ll hopefully walk away with new ways to keep some extra money in your pockets. (If not, at least it was more fun to read, right?)

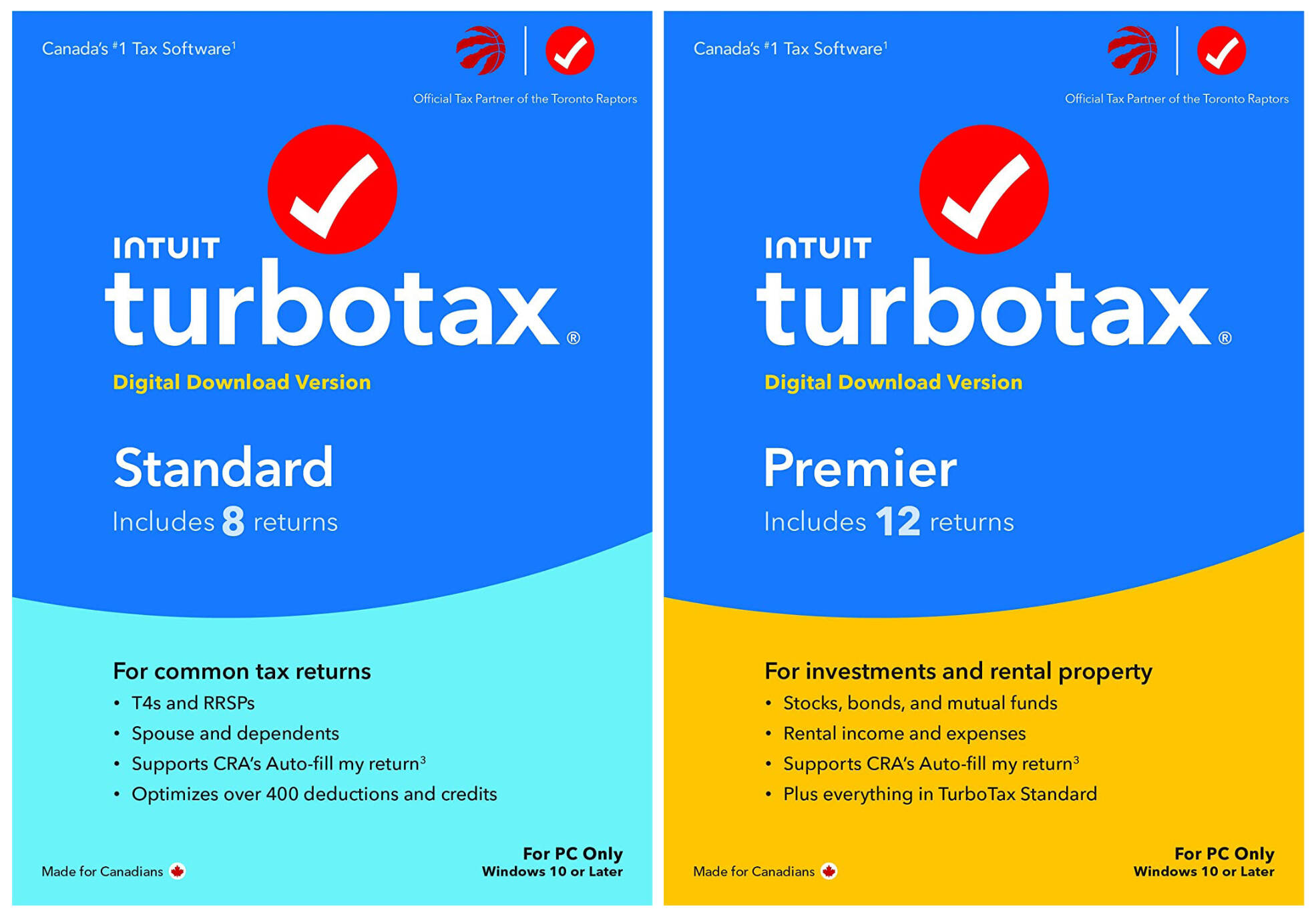

DIY Tax kits from TurboTax:

Does your mother know that you…still can’t do your own taxes?

If you’ve been working all night and working all day to pay the bills you have to pay, you should probably be getting your T4s in the mail soon. Have you ever considered doing your taxes yourself? It’s not as complicated as you might think with online DIY tax programs like TurboTax. Skip the wait times and appointments this year and pick up an easy tax preparation kit from the TurboTax store. Find a wide range of options and prices available to meet the needs of most Canadians, from their basic kit (Standard 2022 kit ) to their premier option, which includes support for investments and rental property income!

Taxes aside, everyone is looking for ways to save money this winter. But, you don’t have to leave, you don’t have to go…To Las Vegas or Monaco….to win a fortune in a game, so your life will never be the same…Instead try one or two of our top suggestions to save money in 2023.

(We’ve also included some finance-related best sellers near the end and if you want to offset the stress of money-related reading you could always try some self-care suggestions from our January article.)

Budgeting planners and cash diets:

Knowing me, knowing you – we both have terrible spending habits, but there is something we can do!

The first step in gaining better control of your bank account is knowing where you’re spending and where you can make changes to save money in your day-to-day life.

Cash diets have long been a popular way to get your finances under control. Spending cash rather than using a card or an app on your phone or smartwatch makes a stronger connection in your brain. People think twice about spending cash and tend to spend less than when they use cards or similar methods instead. Additionally it’s also much easier to organise a tangible item than it is a virtual one.

Clever Fox offers an all-in-one budget planner and monthly bill organizer that even has space for expense tracking, notes and pockets if you want to take the cash diet approach to budgeting.

They also offer separate cash envelopes that are water- and tear-resistant and come with a carry pouch and their own expense sheets to further organise your money and your monthly, weekly and daily expenses.

The viral 100-envelope, 100-day challenge:

I have a dream, a song to sing, To help me cope with anything…and that dream is a savings account!

If you’re looking for a savings hack that actually works, the 100 envelope challenge is a popular online approach to savings that’s blissfully easy to follow. And if you’re successful, well let’s just say…the winner takes it all!.

First things first! You’ll need 100 white envelopes. These ones work well as they have no windows and are easy to seal (so you won’t be tempted to cheat!).

The rules are simple:

- Day 1 – Put $1 in the first envelope.

- Day 2 – Put $2 in the second envelope.

- Day 3 – Put $3 in the third envelope…

Like we said, simple right? Day 80 and you’re putting $80 in the 80th envelope and by day 100 you’ll have $5,050 in total.

Another variation is to pre-number each envelope and then pick whichever one you can swing on that given day (this approach can be easier if you have more money at certain times of the month and want to plan ahead to make sure you’re not having to put away $90 on a tight week).

The biggest problem people have with this challenge is the cash…many of us don’t carry it anymore. You can complete this challenge through online banking and move the money over to savings everyday (if you don’t incur bank fees) but there’s some logic behind using cold, hard, physical cash.

By using physical money, you’re less likely to “cheat” and borrow from your envelopes, especially if you’re sealing them up and can’t see the money inside (out of sight, out of mind).

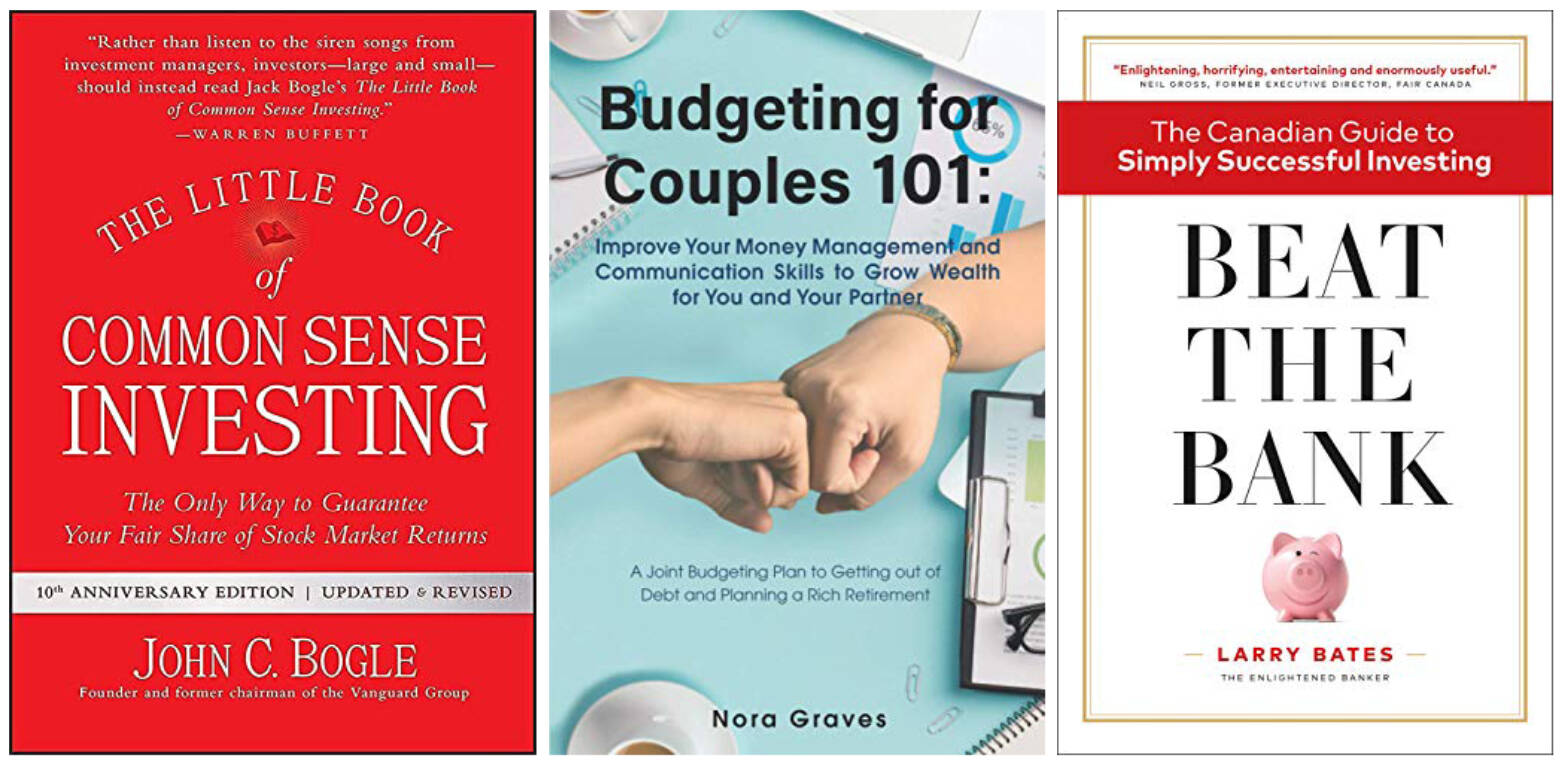

Best-selling books on finances and budgeting for 2023:

Books on finances, budgeting and generating more income are in no short supply but we’ve narrowed down our top picks based on popularity and over-all reviews!

- Budgeting for Couples 101

- Financial Feminist: Overcome the Patriarchy’s Bullsh*t to Master Your Money and Build a Life You Love

- Financial Freedom: A Proven Path to All the Money You Will Ever Need

- The 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich

- The Psychology of Money: Timeless lessons on wealth, greed, and happiness

- The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

- Beat the Bank: The Canadian Guide to Simply Successful Investing

- The Total Money Makeover: A Proven Plan for Financial Fitness

Slipping through your fingers all the time…it’s never too early to set them up for financial success!

You made it! Congratulations and for those keeping count… we managed to slip in a total of nine ABBA lyrics, not too bad for a finance article, if we do say so ourselves.

Don’t forget to check out our 2023 health and wellness trends, and how to put your personal health and wellness first this year!

www.todayinbc.com/marketplace/make-2023-the-year-for-you

Hasta mañana ‘till we meet again.