With construction well underway and hundreds of thousands of dollars already spent, one might have thought the Ridley Island Energy Export Facility REEF project was a done deal.

Nevertheless, Altagas and Royal Vopak made it official May 29 with a “positive final investment decision.”

The joint venture now expects the $1.35 billion large-scale liquefied petroleum gas (LPG) and bulk liquids terminal to come online by the end of 2026. A press release stated they anticipate an annual return on that investment of $185 to $215 million (earnings before interest, taxes, depreciation and amortization).

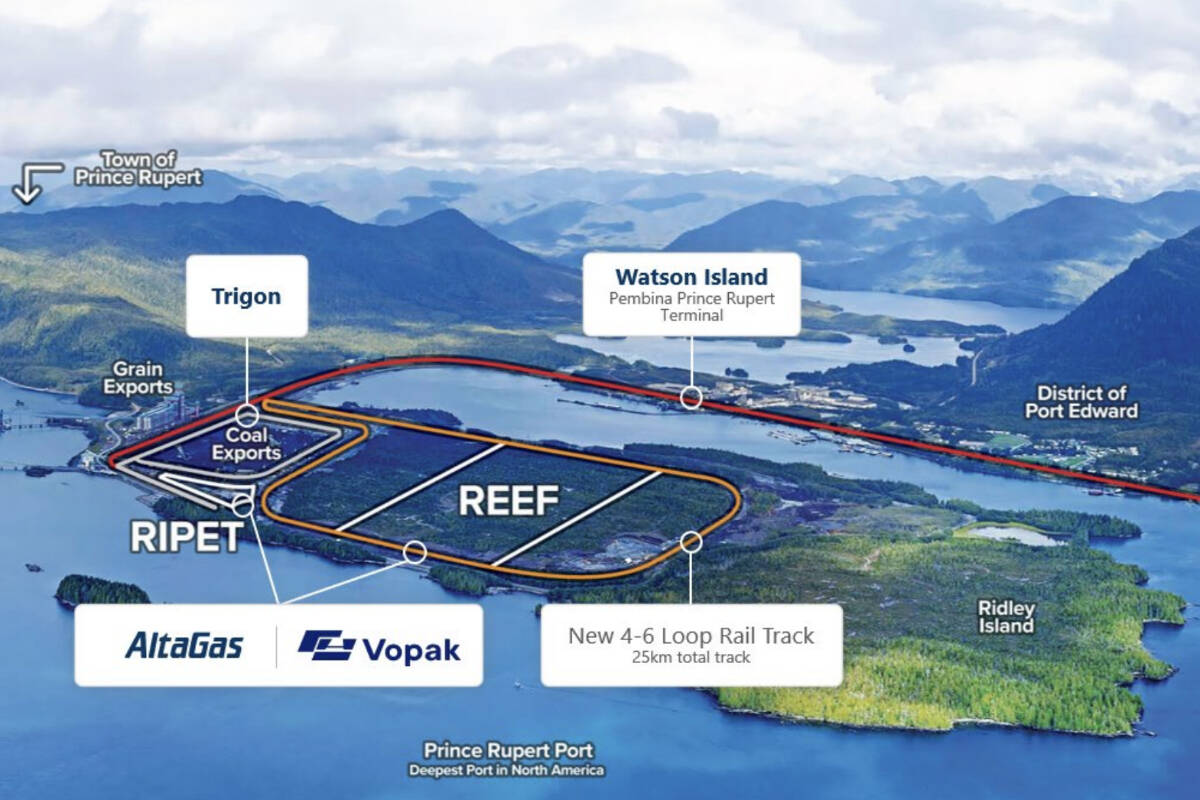

The investment includes $875 million for construction of the facility, plant and LPG storage tanks and $475 million for construction of a new dedicated jetty and extensive rail and logistics infrastructure.

The release also said the project has “First Nations support agreements in place and will drive further economic benefits to local communities in Northwestern B.C. through construction activities, long-term job creation and community investment focused on delivering positive outcomes for all stakeholders.”

As of the end of May, the venture said land clearing on the 190-acre site is 95 per cent complete.

”Canada has a structural advantage in delivering LPGs to Asia with the shortest shipping time and lowest maritime emissions footprint,” said Vern Yu, president and CEO of AltaGas, adding the company already delivers 19 per cent of Japan’s propane and 13 per cent of South Korea’s LPG imports.

In a press release May 30, the Prince Rupert Port Authority (PRPA) congratulated the two companies.

“This is an incredible milestone for the Port of Prince Rupert as it marks the largest investment in the Port’s history, with a capital cost of $1.35 billion,” said Shaun Stevenson, PRPA president and CEO.

“This project solidifies Canada’s critical role in the global energy transition and also confirms the Port of Prince Rupert’s leading role in enabling and diversifying Canada’s trade portfolio.”

The companies said the exclusive rights to develop LPG, methanol and other bulk liquids exports on Ridley Island granted to them by the port authority were critical to their final investment decision.

“The provision of these exclusive rights was important to ensure the certainty needed to advance large capital projects through long and fulsome development periods and ensure developers advance projects with comprehensive environmental and community stewardship,” the release stated.

Those rights, however, are currently the subject of a lawsuit. Trigon — whose existing coal export facility sits right next door to the REEF project on Ridley — also wants to develop an LPG export terminal and is advancing plans to do so.

Trigon says the port cannot grant exclusivity because it facilitates a monopoly, which is contrary to the port’s responsibilities under the Canada Marine Act.

“It is deeply disappointing that the PRPA as a public agency of the Government of Canada continues to try to hide the details of their deal, without putting the best interests of all Canadians first,” said Rob Booker, Trigon’s CEO.

So far Trigon has obtained a court order requiring the PRPA to produce documents related to the exclusivity agreement and resisted an attempt by the port to have the REEF partnership added to the lawsuit.

OTHER NEWS: Nisga’a Society buys land downtown for affordable housing