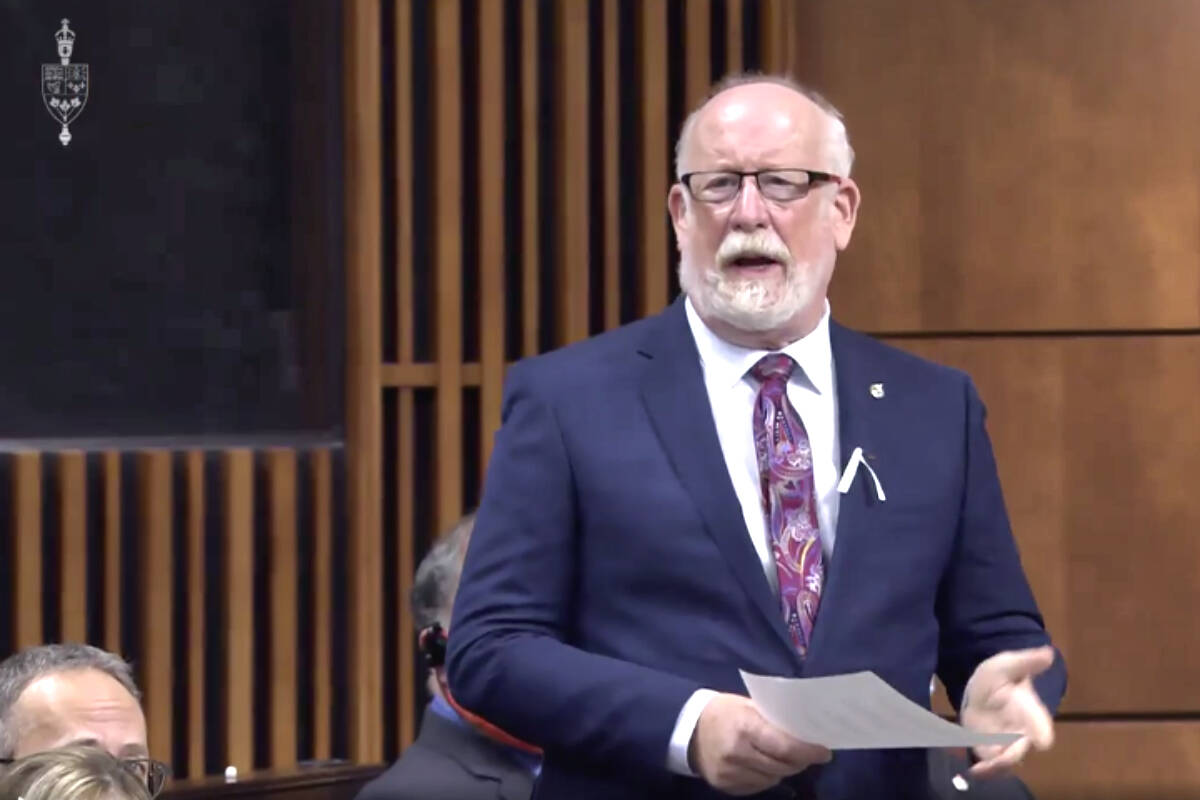

South Okanagan-West Kootenay MP Richard Cannings thinks it’s time to correct a federal “tax inconsistency” associated with the sale of low-alcohol beer.

Cannings proposed to eliminate the excise tax on the product when he tabled Bill C on Thursday, March 31, in the House of Commons.

Representatives from the New Democrats called the bill a way “to help people with the rising costs of groceries” in an email sent to media on Thursday morning.

“An error was made and the result is that Canada doesn’t treat all low-alcohol beverages equally,” Cannings said while referencing that low-alcoholic wine and spirits are currently not subject to a tax.

“Just like the other low-alcohol choices we find in grocery stores, low-alcohol beer is a health-conscious and increasingly popular choice that we should not deter.”

Only beer with an alcoholic percentage of 0.5 or below is subject to the new proposal.

“Canada is the only country we’re aware of that currently applies an excise tax on non-alcohol beer,” said Luke Chapman, the vice-president of Beer Canada.

“Fixing this issue will send a positive signal to the industry.”

In 2020, the federal government collected over $1 million in tax on low-alcoholic beer, according to Cannings’ NDP colleagues.

The South Okanagan-West Kootenay MP is hopeful that the elimination of the excise tax would help expand domestic production of low-alcohol beer.

Cannings’ proposal comes one week before the unveiling of the 2022 budget by the Liberal government. It will be the first tabled budget since the 2021 federal election.

“Cannings’ bill aims to quickly correct the excise tax inconsistency with hopes of the government including it in its budget implementation act in the coming weeks,” representatives from the NDP wrote in an email.

READ MORE: Penticton climate change rally urges support for ‘Just Transition Act’

@lgllockhart

logan.lockhart@pentictonwesternnews.com

Like us on Facebook and follow us on Twitter.