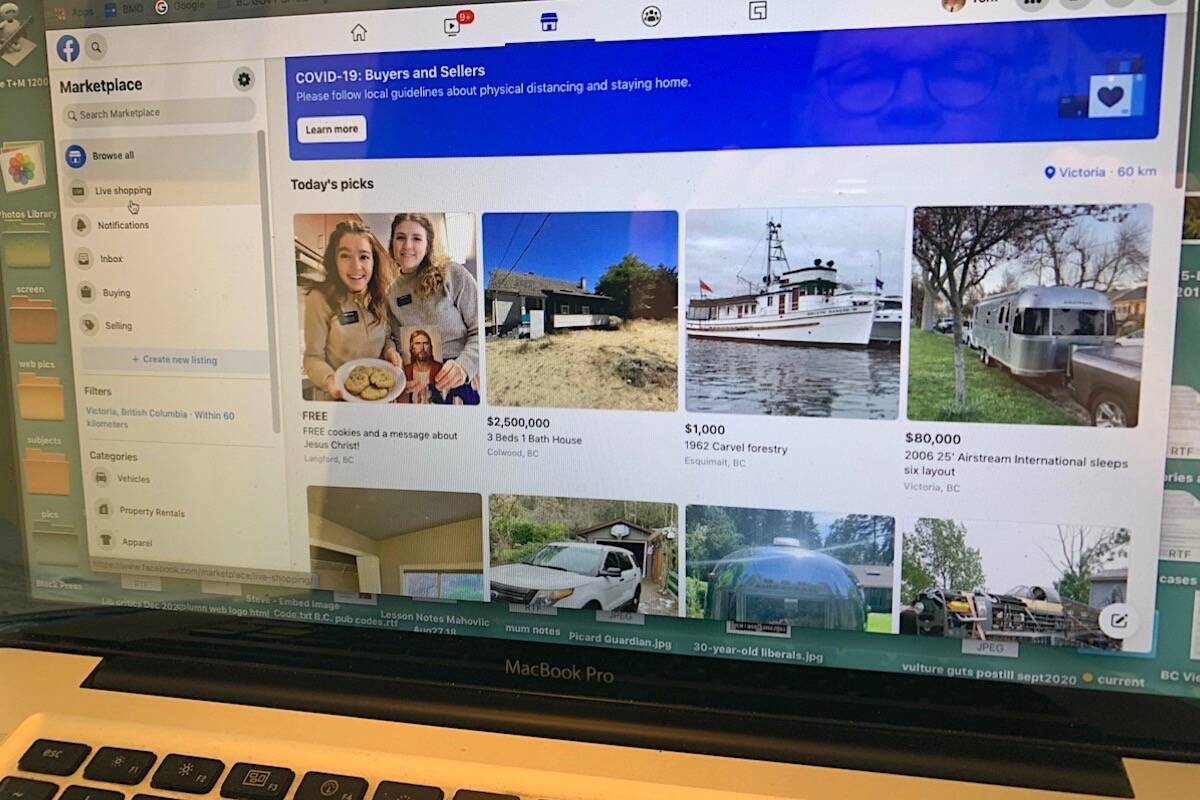

B.C. is extending its new sales tax for out-of-country online services to take in private sale services such as Facebook Marketplace starting July 1.

B.C.’s NDP government first extended its seven-per-cent sales tax (PST) to streaming services such as Netflix and Disney+ in April 2021, applying the same tax rules to foreign providers as Canadian streaming services such as CraveTV were already paying sales tax.

Popularly known as the “Netflix tax,” B.C.’s legislation was similar to that applied in Saskatchewan, Manitoba, Quebec and by the federal government. Sellers of digital software and telecommunication services were only required to register, collect and remit PST if they reach $10,000 sales in a year. The same threshold applies to what a B.C. taxation bulletin describes as “marketplace facilitators.”

In budget debate in the B.C. legislature, B.C. Liberal jobs and innovation critic Todd Stone described the marketplace sales tax as another of tax increase that adds to costs for lower-income people. Finance Minister Selina Robinson’s Feb. 22 budget also included a requirement to charge PST on the book value of private used car sales, whatever the actual price paid.

“A struggling family decides to go to Facebook online and purchase a new parka for their child or decides to go on to Facebook to sell some surplus skis or sports equipment to raise a few extra bucks to maybe buy a few more groceries,” Stone told the B.C. legislature March 3. “It’s odd that this government would choose that as an area to target for adding additional tax onto the backs of, again, the lower- and middle-income British Columbians that would be predominantly impacted by that.”

RELATED: B.C. applies sales tax to streaming, vaping, sweet drinks

RELATED: B.C. budget ‘closing loophole’ on private used car sales

In a commentary on the Feb. 22 B.C. budget, lawyers Roger Smith and Alan Kenigsberg of Osler said it is not yet clear whether customers would have to pay more to use services like Facebook Marketplace, or if only sellers would pay tax on the marketplace service they receive. They note that the budget states the changes “do not introduce new taxes on taxable goods, software or taxable services obtained through online platforms,” but the lawyers add that, “we will need to see the actual legislation to confirm that this is the case.”

@tomfletcherbc

tfletcher@blackpress.ca

Like us on Facebook and follow us on Twitter.