Elimination of the property transfer tax for first-time buyers on B.C. properties valued up to $1 million is one of four key policies in BC United’s housing platform,

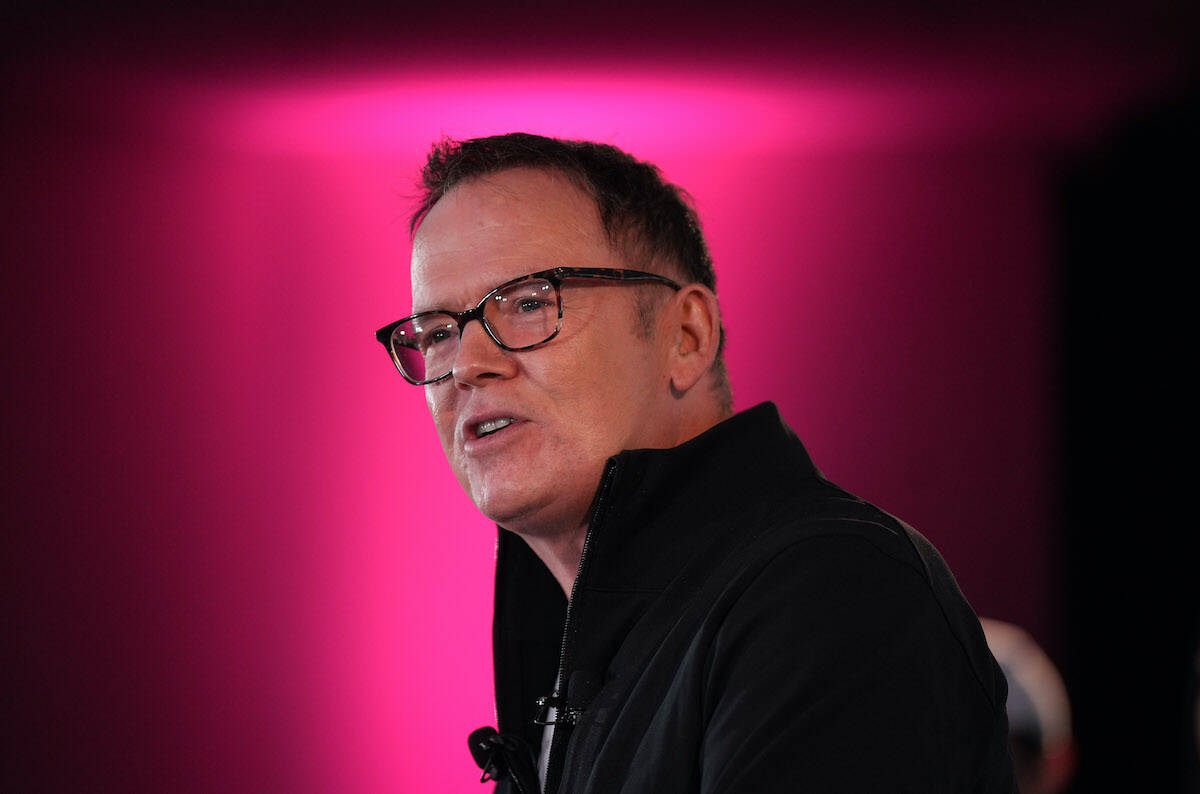

The party also proposes to use empty public land to build affordable housing, eliminate the PST on residential construction and launch a rent-to-own program, BC United Leader Kevin Falcon announced Thursday (Feb. 15) in Victoria.

Falcon said the policies — especially the elimination of the property transfer tax — will help people get into the market by making housing less expensive.

Cost and financing for the promised moves were not immediately clear, with Falcon saying it starts with “being responsible with public dollars” and putting harvested savings toward making sure people get into housing.

“We can only do rough estimates because we are not in government, so we don’t have access to all of the information that I would have had when I was minister of finance,” Falcon added. “But what I can tell you is this, that the costs involved are just a fraction of what the NDP is proposing to spend recklessly with taxpayers’ dollars to do really idiotic things like provide subsidies to people earning up to $200,000 a year, so that they can have more affordable rent.”

Falcon was referring to BC Builds, a new government program supporting construction of rental housing targeted to those with a household income between roughly $84,000 and $190,000.

It is also not clear how many units the four proposals — which will be followed by others — are expected to create.

“The good thing is our proposal can happen immediately,” he said.

The rent-own-program would require developers to reserve up to 15 percent of new homes for eligible British Columbians who have never purchased homes before. They would rent for three years with 100 per cent of their rent going toward their down payment.

RELATED: Capacity and scale questions greet new BC Builds program

RELATED: B.C. launches new agency to build middle-income rental housing quicker

“I can tell you the biggest barrier to young people getting into housing is the down-payment,” Falcon said. “What young couple today could ever afford to save $90,000 or $100,000? This is how they do it.”

Falcon said the elimination of the PST for properties up to $1 million would save people up to $18,000, making it more affordable to purchase a home. By way of context, the average MLS residential price in B.C. in January 2024 was $957,909.

“(Most) first time buyers realistically are not going to be able to afford something more than $1 million,” Falcon said. He said his first property was a townhome, which then eventually turned into a single family home, after many years.

“That’s often the experience of most people getting into the housing market, but there are many homes available for just under $1 million and even if it is over $1 million — remember, for the first $1 millon, they pay absolutely no tax,” he said. “Yes, there is a sliding scale…but that is why we are trying to help people get into the marketplace, make it less expensive.”

Thursday’s announcement came two days after Premier David Eby had announced BC Builds. Falcon framed his party’s quartet of policies as a more market-friendly approach.

“I can’t think of anything more terrifying than a government led by David Eby and Adrian Dix and all these people, (who) have no private sector experience, saying ‘we are going to build a whole bunch of housing.’ It’s going to be a disaster and it will cost taxpayers a fortune.”

One of BC United’s four proposals — offering non-profit and market homebuilders 99-year leases on unused public land at one dollar per year in exchange for building below-market rental housing for families and seniors — bears similarities to BC Builds.

Falcon said what’s different is his government would set out clear criteria.

“What you do not want to do is what the NDP are trying to do, which they believe now that they are going to get into the building business,” he said. “My God, all we have to do is look at the nightmare they have created over at BC Housing (once headed by Eby).”